"We found a stark contrast between our previous program versus what we have now with State National. Our old program never really could get it right. We had a lot of pain and noise. After the move to State National it was like night and day. The whole tracking system is better and so much more accurate. From day one, the tracking and automation was just 100% better."

Proactive, Not Reactive

It's as true in portfolio protection as it is in life: Better results come from anticipating situations and preventing problems, instead of reacting after issues appear. That's why we invest abundant time and resources toward preventive measures to avoid member friction — before it ever happens.

Unbundle Your Credit Union and Choose Expertise

InsurTrak:

State National designed InsurTrak from the ground up to be the best insurance tracking system in the industry — and it's all about easy. It delivers easy insurance tracking, easy claims filing, and easy-to-understand reports — all in one place. It's the only system built specifically for portfolio tracking and protection.

WRAP (Web-Based Automated Processing):

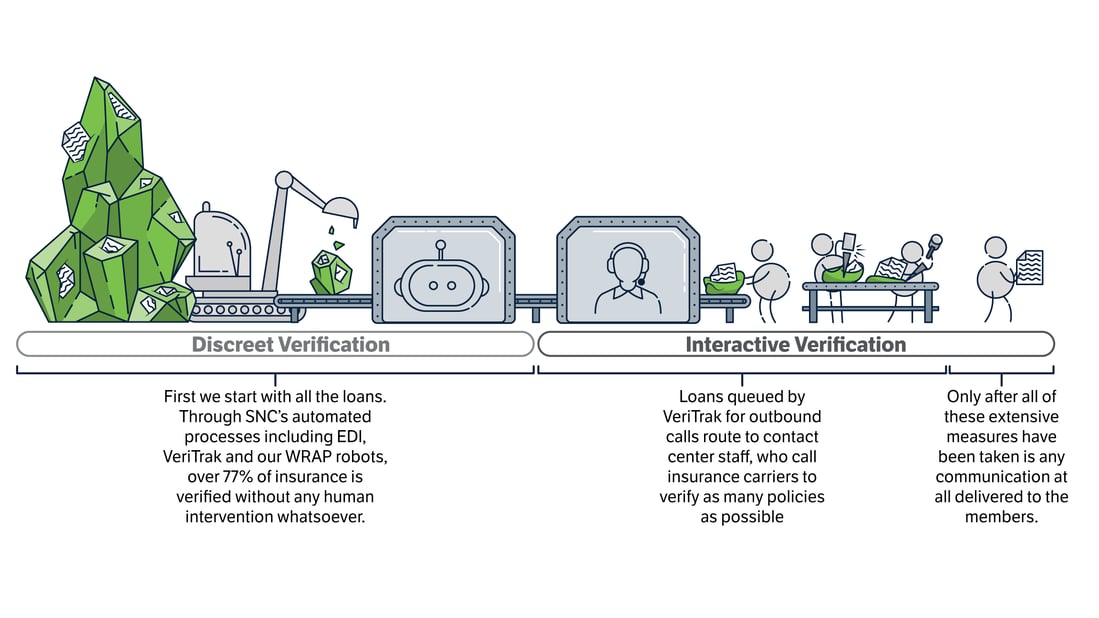

Our AI software robots crawl into insurers’ sites, capturing real-time member information and updating InsurTrak in seconds. New loans are run through WRAP, too — which means more insurance information gathered with no member contact.

VeriTrak:

Our one-of-a-kind outbound verification system receives policy information from InsurTrak and automatically routes it to either our AI-powered WRAP bots or to contact center staff, based on carrier. It queues verifications based on due date and time, for maximum efficiency.

Merlin:

Our proprietary Claims Management system automates claims workflows and processing, allowing us to maintain our unbroken record of industry-best turn times for claims payments. That means adding more money, faster, to your credit union's bottom line.

"Between the people, the service, the technology, the product, and the answers we got when we went out into the industry to do reference checks — State National just rose to the top. I just don’t think anybody else out there can compete with what State National has as far as the product, the technology and innovation, and how many things are automated."

"I've been in this business for about 20 years and worked with different CPI companies throughout the years, and with State National it's a different feel. Working with State National, I get that efficient, seamless process I didn't have with other companies I’ve worked with."

"Before we switched to State National and InsurTrak I was probably spending at least two hours a day, looking at reports, manually posting and manually refunding. Some days, more than that. Now, it might be 15 minutes. It’s night and day."

"Filing claims is very easy — you just go in, key everything in, and that's it. It's all very easy, and State National pays very quickly""