"InsurTrak is so much better than our previous provider's system for ease of use, greater functionality, and immediate access to information. It's so easy to use that I was able to go in and get everything I needed before even being trained."

Proactive, Not Reactive

It's as true in portfolio protection as it is in life: Better results come from anticipating situations and preventing problems, instead of reacting after issues appear. That's why we invest abundant time and resources toward preventive measures to avoid borrower friction — before it ever happens.

Unbundle Yourself and Choose Expertise

InsurTrak

InsurTrak is the industry’s most advanced and user-friendly insurance tracking system, purpose-built for CPI and designed to make everything easy. From seamless insurance tracking and claims filing to real-time borrower transaction access and on-demand performance reporting, InsurTrak puts everything you need in one place. With instant, one-click access to insurance details — including borrower calls and chats — and powerful automation that eliminates routine administrative tasks, InsurTrak streamlines program management and keeps you in control without delays or guesswork.

VeriTrak

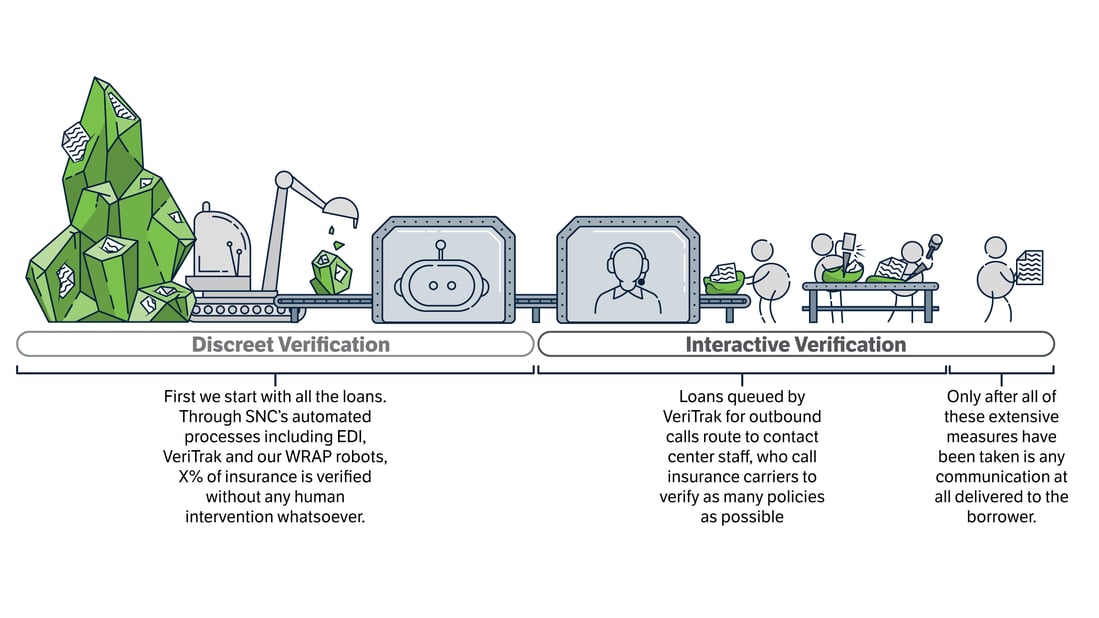

Our one-of-a-kind outbound verification system receives policy information from InsurTrak and automatically routes it to either our AI-powered verification process or to contact center staff, based on carrier. Verifications are queued based on due date and time, for maximum timeliness and efficiency.

Proactive AI Verification

State National’s advanced AI technology has accelerated insurance verification results by automating once-manual processes. Our AI-powered process captures real-time borrower insurance data from insurers’ websites, updating InsurTrak in seconds. This innovation eliminates bottlenecks, boosts speed and accuracy, and reduces unnecessary touchpoints — all without human intervention.

APIs

Custom integrations with APIs from our extensive API library make insurance management simpler and more effective than ever before. Transforming insurance management, our exclusive InsurPath™ API lets borrowers seamlessly update insurance details through their online banking platform while empowering lenders to communicate directly within the same space. This industry-first innovation boosts compliance and delivers measurable results.

“Since we began our partnership with State National, we’ve been able to reduce false forced placements by almost two-thirds, which definitely elevates the customer experience.”

"We found a stark contrast between our previous program versus what we have now with State National. Our old program never really could get it right. We had a lot of pain and noise. After the move to State National it was like night and day. The whole tracking system is better and so much more accurate. From day one, the tracking and automation was just 100% better."

"Between the people, the service, the technology, the product, and the answers we got when we went out into the industry to do reference checks — State National just rose to the top. I just don’t think anybody else out there can compete with what State National has as far as the product, the technology and innovation, and how many things are automated."